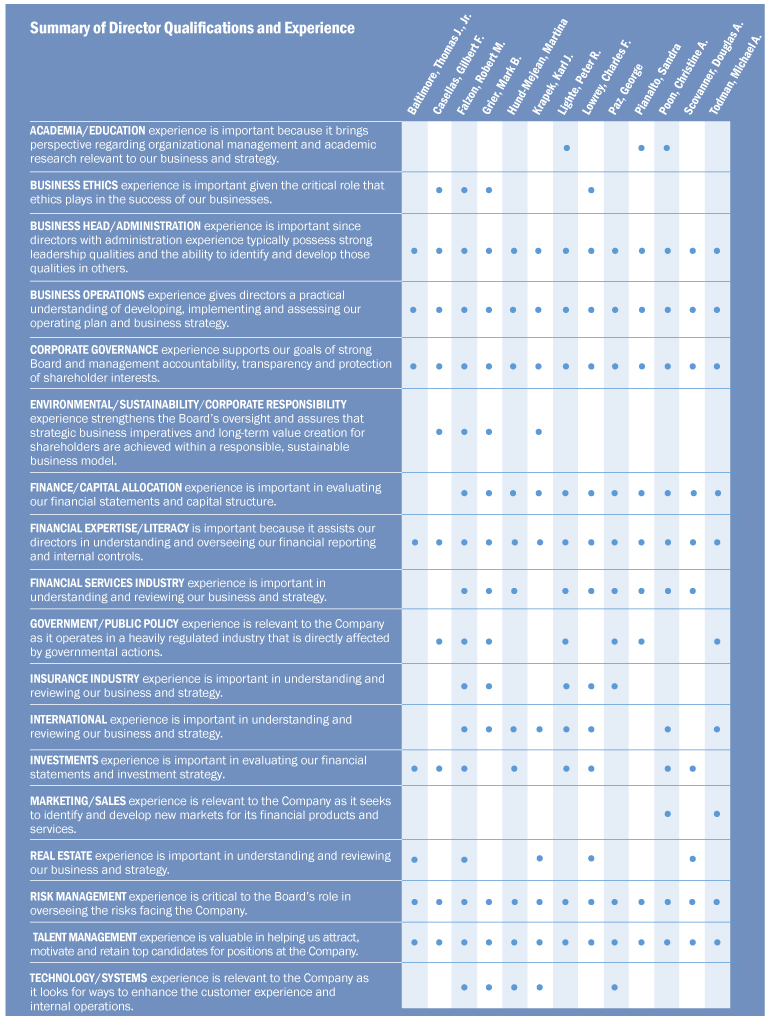

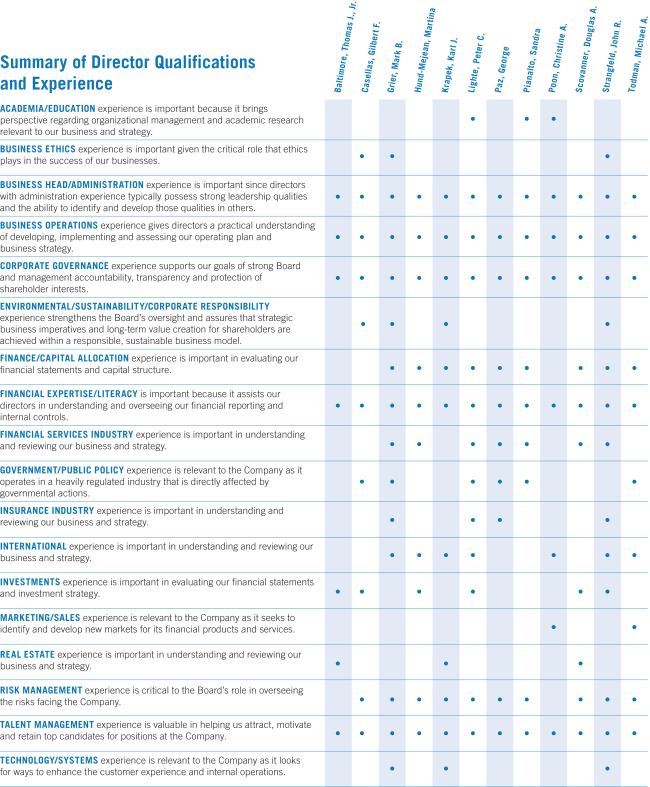

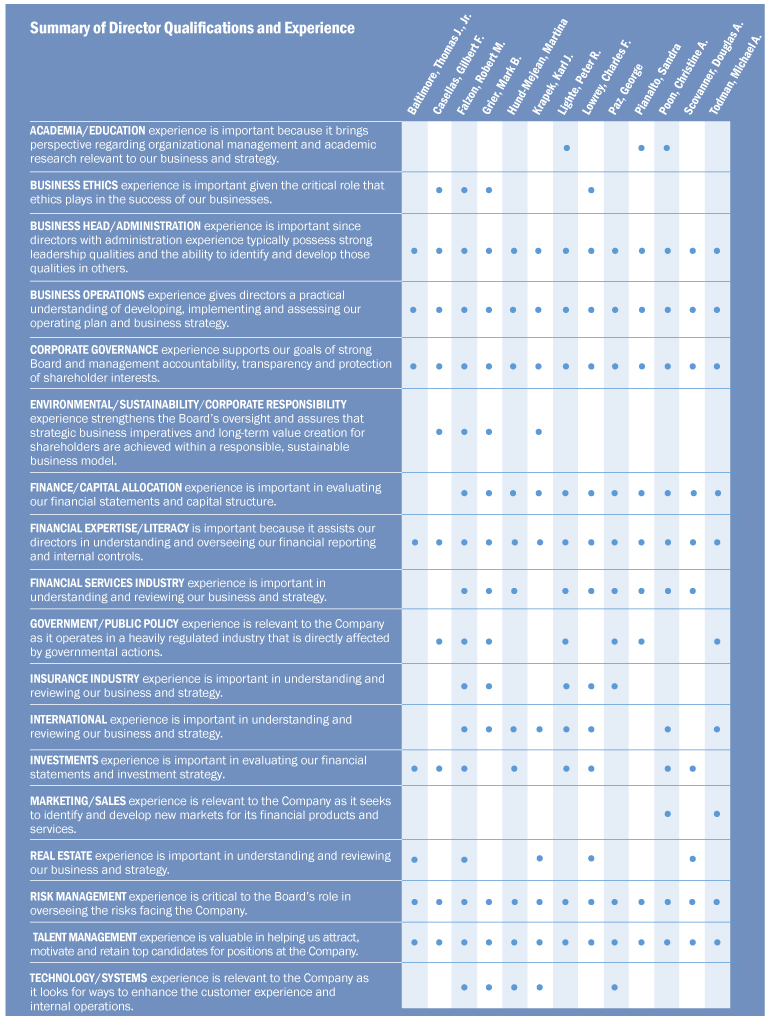

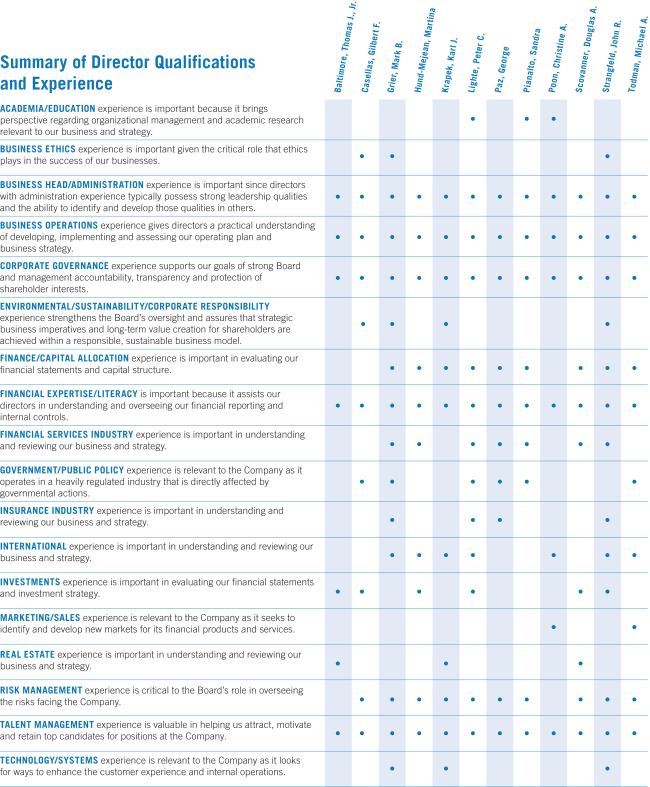

| Mr. Casellas served as the Chairman of OMNITRU (a consulting and investment firm) from 2011 to 2017. He was the VP, Corporate Responsibility, of Dell Inc. (a global computer manufacturer) from 2007 to 2010. He served as a Member of Mintz Levin Cohn Ferris Glovsky & Popeo, PC from June 2005 to October 2007. He was the President of Casellas & Associates, LLC (a consulting firm) from 2001 to 2005. During 2001, he served as President and CEO ofQ-linx, Inc. and served as the President and COO of The Swarthmore Group, Inc. from January 1999 to December 2000. Mr. Casellas served as Chairman, U.S. EEOC from 1994 to 1998, and General Counsel, U.S. Department of the Air Force, from 1993 to 1994. | | Skills & Qualifications | | | • Business Ethics • Business Head/Administration • Business Operations • Corporate Governance • Environmental/Sustainability/Corporate Responsibility • Government/Public Policy • Investments | | • Risk Management • Talent Management |

| | | | | | | | | | | | | |  | | Mark B. Grier

Age:64

Director Since:January 2008

| | Prudential Committees:

Robert M. Falzon • None Age:59

To be elected as a Director:August 2019 | | | | | | | | | | | | | | | |

Mr. Grier has served as Vice Chairman since 2007 and a member of the Office of the Chairman of Prudential Financial since August 2002. From April 2007 through January 2008, he served as Vice Chairman overseeing the International Insurance and Investments divisions and Global Marketing and Communications. Mr. Grier was Chief Financial Officer (CFO) of Prudential Insurance from 1995 to 1997 and has served in various executive roles. Prior to joining Prudential, Mr. Grier was an executive with Chase Manhattan Corporation.

| | | | | Mr. Falzon was elected Vice Chairman of Prudential Financial in December 2018. Previously, he served as Executive Vice President and CFO of Prudential Financial from 2013 to 2018, and has been a member of the Company’s Executive Leadership Team since 2013. Mr. Falzon also served as Senior Vice President and Treasurer of Prudential Financial from 2010 to 2013. Mr. Falzon has been with Prudential since 1983, serving in various positions including managing director at PGIM Real Estate (“PGIM RE”), head of PGIM RE’s Global Merchant Banking Group and CEO of its European business. He was also a Senior Portfolio Manager, a member of PGIM RE’s Global Investment and Management Committees, Chairman of the Global Real Estate Securities Investment Committee and the Currency Hedging Committee, and a member of the Investment Committee for Prudential Investment Management. | | Skills & Qualifications | | | • Business Ethics • Business Head/Administration • Business Operations • Corporate Governance • Environmental/Sustainability/Corporate Responsibility • Finance/Capital Allocation • Financial Services Industry • Government/Public Policy • Insurance Industry • International • Investments | | • Real Estate • Risk Management • Talent Management • Technology/Systems | | |

| | | | | | | | 12 | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement |

| | |

| | Item 1—Election of Directors:Director Nominees | |

| | | | | | | | |  | | Mark B. Grier Age:66 Director Since:January 2008 Mr. Grier is expected to retire from Prudential in August 2019 and will leave the Board at that time. | | Prudential Committees: • Risk | | | | | | | | | | | | | | | | | Mr. Grier has served as Vice Chairman of Prudential Financial since 2007 and a member of the Company’s Executive Leadership Team since 2002. Mr. Grier will be retiring from the Company no later than August 30, 2019 and will leave the Board at that time. Upon his retirement, it is expected that Robert Falzon’s service on the Board will commence. From April 2007 through January 2008, Mr. Grier served as Vice Chairman of Prudential Financial overseeing the International Insurance and Investments divisions and Global Marketing and Communications. Mr. Grier was CFO of Prudential Insurance from 1995 to 1997. Prior to joining Prudential, Mr. Grier was an executive with Chase Manhattan Corporation. | | Skills & Qualifications • Business Ethics • Business Head/Administration • Business Operations • Corporate Governance • Environmental/Sustainability/ Corporate Responsibility • Finance/Capital Allocation | | • Financial Services Industry • Government/Public Policy • Insurance Industry • International • Risk Management • Talent Management • Technology/Systems |

| | | | | | | | | |  | | | |  | | Martina Hund-Mejean Age:5658 Director Since:October 2010 | | Prudential Committees: • Audit | | | | | | | | | | | | | |

Ms. Hund-Mejean has served as the CFO and a member of the Executive Committee at MasterCard Worldwide (a global transaction processing and consulting services company) since 2007. Ms. Hund-Mejean served as Senior Vice President (SVP) and Corporate Treasurer at Tyco International Ltd. from 2003 to 2007; SVP and Treasurer at Lucent Technologies from 2000 to 2002; and held management positions at General Motors Company from 1988 to 2000. Ms. Hund-Mejean began her career as a credit analyst at Dow Chemical in Frankfurt, Germany.

| | | | | Ms. Hund-Mejean has served as the CFO and a member of the Executive Committee at Mastercard Worldwide (a global transaction processing and consulting services company) since 2007. She has announced her intention to step down as CFO of Mastercard Worldwide effective April 1, 2019. Ms. Hund-Mejean served as Senior Vice President (SVP) and Corporate Treasurer at Tyco International Ltd. from 2003 to 2007; SVP and Treasurer at Lucent Technologies from 2000 to 2002; and held management positions at General Motors Company from 1988 to 2000. Ms. Hund-Mejean began her career as a credit analyst at Dow Chemical in Frankfurt, Germany. | | Skills & Qualifications | | | • Business Head/Administration • Business Operations • Corporate Governance • Finance/Capital Allocation • Financial Services Industry • International • Investments | | • Risk Management • Talent Management |

• Technology/Systems | | | | | | | Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | | | | 11 | |

| | |   | | Item 1—Election of Directors:Director Nominees

|

| | | | | | | | | | | | | |  | | Karl J. Krapek Age:6870 Director Since:January 2004 Lead Independent Director since May 2014

| | Prudential Committees: • Compensation (Chair) • Executive (Chair) • Risk (Chair) | | Public Directorships: Former Directorships Held During the Past Five Years:• Northrop Grumman

Corporation

• Visteon Corporation (June 2012) • The Connecticut Bank & Trust Company (April 2012)Pensare Acquisition Corp.

| | Public Directorships:

• Northrop Grumman Corporation

| | | | | | | | | | | |

Mr. Krapekserved as the President and COO of United Technologies Corporation (UTC) from 1999 until his retirement in January 2002. Prior to that time, Mr. Krapek held other management positions at UTC, which he joined in 1982. Mr. Krapek is also theco-founder of The Keystone Companies, which was founded in 2002 and develops residential and commercial real estate.

| | | | | Mr. Krapekserved as the President and COO of United Technologies Corporation (UTC) from 1999 until his retirement in January 2002. Prior to that time, Mr. Krapek held other management positions at UTC, which he joined in 1982. Mr. Krapek is also theco-founder of The Keystone Companies, which was founded in 2002 and develops residential and commercial real estate. | | Skills & Qualifications | | | • Business Head/Administration • Business Operations • Corporate Governance • Environmental/Sustainability/Corporate Responsibility • Finance/Capital Allocation • International • Real Estate | | • Risk Management • Talent Management • Technology/Systems | | |

| | | | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement | | | | | 13 |

| | |

| | Item 1—Election of Directors:Director Nominees | |

| | | | | | | | | | | | | |  | | Peter R. Lighte Age:6870 Director Since:March 2016 | | Prudential Committees: • Corporate Governance and Business Ethics • Investment | | | | | | | | | | | | | |

Mr. Lighteserved as the Vice Chairman, J.P. Morgan Corporate Bank, China, from 2010 to 2014, and was the founding Chairman of J.P. Morgan Chase Bank China, from 2007 to 2010. Prior to that, he headed the Company’s International Client Coverage for Treasury and Securities Services in J.P. Morgan’s European Global Operating Services Division and was instrumental inre-establishing its corporate bank in London. Mr. Lighte previously served as the President of Chase Trust Bank in Tokyo from 2000 to 2002. He was also the founding representative in Beijing of Manufacturers Hanover Trust Company. Mr. Lighte has also taught at several academic institutions, including Middlebury College and the University of Santa Clara.

| | | | | Mr. Lighte served as the Vice Chairman, J.P. Morgan Corporate Bank, China (a global financial services company), from 2010 to 2014, and the founding Chairman of J.P. Morgan Chase Bank China, from 2007 to 2010. Prior to that, he headed the company’s International Client Coverage for Treasury and Securities Services in J.P. Morgan’s European Global Operating Services Division and was instrumental inre-establishing its corporate bank in London. Mr. Lighte previously served as the President of Chase Trust Bank in Tokyo from 2000 to 2002. He was also the founding representative in Beijing of Manufacturers Hanover Trust Company. Mr. Lighte has also taught at several academic institutions, including Middlebury College and the University of Santa Clara. | | Skills & Qualifications | | | • Academia/Education • Business Head/Administration • Business Operations • Corporate Governance • Finance/Capital Allocation • Financial Services Industry • Government/Public Policy | | • Insurance Industry • International • Investments • Risk Management • Talent Management | | |  | | Charles F. Lowrey Age:61 Director Since:December 2018 | | Prudential Committees: • Executive | | | | | | | | | | | | | | | | | | Mr. Lowrey was elected CEO and President of Prudential Financial and Prudential Insurance in December 2018. As of April 5, 2019, Mr. Lowrey will become the Chairman of the Board of Directors of Prudential Financial and Prudential Insurance. Previously, he was Executive Vice President and COO, International Businesses, of Prudential from 2014 to 2018. He also served as Executive Vice President and COO, U.S. Businesses, of Prudential from 2011 to 2014. He has been a member of the Company’s Executive Leadership Team since 2011. He was CEO and President of Prudential Investment Management, Inc. from January 2008 to February 2011 and CEO of PGIM Real Estate from February 2002 to January 2008. He joined the Company in March 2001, after serving as a managing director and head of the Americas for J.P. Morgan’s Real Estate and Lodging Investment Banking group, where he began his investment banking career in 1988. He also spent four years as a managing partner of an architecture and development firm he founded in New York City. | | Skills & Qualifications • Business Ethics • Business Head/Administration • Business Operations • Corporate Governance • Finance/Capital Allocation • Financial Services Industry • Insurance Industry • International • Investments • Real Estate • Risk Management • Talent Management | | | | |

| | | | | | | | 14 | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement |

| | |

| | Item 1—Election of Directors:Director Nominees | |

| | | | | | | | | | | | | |  | | George Paz Age:6163 Director Since:March 2016 | | Prudential Committees: • Audit | | Public Directorships: • Express Scripts Holding Company

• Honeywell International, Inc. | | | | | | | Former Directorships Held During the Past Five Years: • Express Scripts Holding Company (December 2018) | | | | | | | | Mr. PazwasNon-Executive Chairman of Express Scripts Holding Company (Express Scripts), a prescription benefit management company, from May 2016 to December 2018 and served as the Chairman and CEO of Express Scripts from May 2006 to May 2016 after being appointed CEO in April 2005. Mr. Paz also served as the President of Express Scripts from October 2003 to February 2014 and as a director from January 2004 to December 2018. He joined Express Scripts in 1998 as SVP and CFO. Prior to joining Express Scripts, Mr. Paz was a partner at Coopers & Lybrand from 1988 to 1993 and 1996 to 1998 and served as Executive Vice President and CFO for Life Partners Group from 1993 to 1995. | | |

Mr. Pazis the Non-Executive Chairman of Express Scripts Holding Company (Express Scripts), a prescription benefit management company, and served as the CEO of Express Scripts from April 2005 to May 2016. Mr. Paz also served as the President of Express Scripts from October 2003 to February 2014 and has been a director since January 2004. He joined Express Scripts in 1998 as SVP and CFO. Prior to joining Express Scripts, Mr. Paz was a partner at Coopers and Lybrand from 1988 to 1993 and 1996 to 1998 and served as Executive Vice President and CFO for Life Partners Group from 1993 to 1995.

Skills & Qualifications | | | • Business Head/Administration • Business Operations • Corporate Governance • Finance/Capital Allocation • Financial Services Industry • Government/Public Policy • Insurance Industry | | • Risk Management • Talent Management |

• Technology/Systems | | | | | 12 | | | Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

| | |  | | Item 1—Election of Directors:Director Nominees

|

| | | | | | | | | | | | | |  | | Sandra Pianalto Age:6264 Director Since:July 2015 | | Prudential Committees: • Corporate Governance and Business Ethics • Finance | | Public Directorships: • Eaton Corporation plc • FirstEnergy Corp. •The J.M. Smucker Company | | | | | | | | | | | |

Ms. Pianaltoserved as the President and CEO of the Federal Reserve Bank of Cleveland (the Cleveland Fed) from February 2003 until her retirement in May 2014. She was the First Vice President and COO of the Cleveland Fed from 1993 to 2003 and served as its VP and Secretary to the Board of Directors from 1988 to 1993. Ms. Pianalto also served in various supervisory roles at the Cleveland Fed from 1983 to 1988. Prior to joining the Cleveland Fed, Ms. Pianalto was an economist at the Board of Governors of the Federal Reserve System and served on the staff of the Budget Committee of the US House of Representatives.

| | | | | Ms. Pianaltoserved as the President and CEO of the Federal Reserve Bank of Cleveland (the Cleveland Fed) from February 2003 until her retirement in May 2014. She was the First Vice President and COO of the Cleveland Fed from 1993 to 2003 and served as its VP and Secretary to the Board of Directors from 1988 to 1993. Ms. Pianalto also served in various supervisory roles at the Cleveland Fed from 1983 to 1988. Prior to joining the Cleveland Fed, Ms. Pianalto was an economist at the Board of Governors of the Federal Reserve System and served on the staff of the Budget Committee of the U.S. House of Representatives. | | Skills & Qualifications | | | • Academia/Education • Business Head/Administration • Business Operations • Corporate Governance • Finance/Capital Allocation • Financial Services Industry • Government/Public Policy | | • Risk Management • Talent Management | | |

| | | | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement | | | | | 15 |

| | |

| | Item 1—Election of Directors:Director Nominees | |

| | | | | | | | | | | | | |  | |

Christine A. Poon Age:6466 Director Since:September 2006 | | Prudential Committees: • Executive • Finance (Chair) • Investment • Risk | | Public Directorships: • Koninklijke Philips Electronics NV • Regeneron Pharmaceuticals • The Sherwin-Williams Company | | | | | | | | | | | |

Ms. Poon served as Dean of Fisher College of Business at The Ohio State University from May 2009 until November 2014 and is now a member of the faculty. She served as Vice Chairman and a member of the Board of Directors of Johnson & Johnson from 2005 until her retirement in March 2009. Ms. Poon joined Johnson & Johnson in 2000 as Company Group Chair in the Pharmaceuticals Group. She became a Member of Johnson & Johnson’s Executive Committee and Worldwide Chair, Pharmaceuticals Group, in 2001, and served as Worldwide Chair, Medicines and Nutritionals from 2003 to 2005. Priorto joining Johnson & Johnson, she served in various management positions at Bristol-Myers Squibb for 15 years.

Skills & Qualifications

Academia/Education

Business Head/Administration

Business Operations

Corporate Governance

International

Marketing/Sales

Talent Management

| | | | | | | | | | Ms. Poonhas served as Executive in Residence at The Max M. Fisher College of Business at The Ohio State University since September 2015 and served as Professor of Management and Human Resources at The Max M. Fisher College of Business from October 2014 to September 2015. Ms. Poon previously served as Dean and John W. Berry, Sr. Chair in Business at The Max M. Fisher College of Business at The Ohio State University from April 2009 until October 2014. She served as Vice Chairman and a member of the Board of Directors of Johnson & Johnson from 2005 until her retirement in March 2009. Ms. Poon joined Johnson & Johnson in 2000 as Company Group Chair in the Pharmaceuticals Group. She became a Member of Johnson & Johnson’s Executive Committee and Worldwide Chair, Pharmaceuticals Group, in 2001, and served as Worldwide Chair, Medicines and Nutritionals, from 2003 to 2005. Priorto joining Johnson & Johnson, she served in various management positions at Bristol-Myers Squibb for 15 years. | | Skills & Qualifications • Academia/Education • Business Head/Administration • Business Operations • Corporate Governance • Finance/Capital Allocation • Financial Services Industry • International • Investments • Marketing/Sales • Risk Management • Talent Management | | | | | |   | |

Douglas A. Scovanner Age:6163 Director Since:November 2013 | | Prudential Committees: • Audit (Chair) • Executive • Risk | | | | | | | | | | | | | |

Mr. Scovanner has been the Founder and Managing Member of Comprehensive Financial Strategies, LLC, a management consulting firm, since October 2013. Previously, he served as the CFO (1994 to 2012) and Executive Vice President (2000 to 2012) of the Target Corporation (a North American retailer). Prior to joining the Target Corporation, Mr. Scovanner held various management positions at The Fleming Companies, Inc., Coca-Cola Enterprises, Inc., The Coca-Cola Company and the Ford Motor Company from 1979 to 1994.

| | | | | Mr. Scovannerhas been the Founder and Managing Member of Comprehensive Financial Strategies, LLC, a management consulting firm, since October 2013. Previously, he served as CFO (1994 to 2012) and Executive Vice President (2000 to 2012) of the Target Corporation (a North American retailer). Prior to joining the Target Corporation, Mr. Scovanner held various management positions at The Fleming Companies, Inc., Coca-Cola Enterprises, Inc., The Coca- Cola Company and the Ford Motor Company from 1979 to 1994. | | Skills & Qualifications | | | • Business Head/Administration • Business Operations • Corporate Governance • Finance/Capital Allocation • Financial Services Industry • Investments • Real Estate | | • Risk Management

• Talent Management

|

| | | | | | | Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | | | | 13 | |

| | |  | | Item 1—Election of Directors:Director Nominees

|

| | | | | | | | | | | | | |  | | John R. Strangfeld

Age:63

Director Since:January 2008

(Elected Chairman May 2008)

| | Prudential Committees:

• Executive

| | | | | | | | | | | | |

Mr. Strangfeld has served as CEO and President of Prudential Financial since January 2008 and Chairman of the Board since May 2008. Mr. Strangfeld is a member of the Office of the Chairman of Prudential Financial and served as Vice Chairman of Prudential Financial from 2002 through 2007, overseeing the U.S. Insurance and Investment divisions. Prior to his position as Vice Chairman, Mr. Strangfeld held a variety of senior investment positions at Prudential, both within the U.S. and abroad.

Skills & Qualifications

| | | • Business Ethics

• Business Head/Administration

• Business Operations

• Corporate Governance

• Environmental/Sustainability/Corporate Responsibility

• Finance/Capital Allocation

• Financial Services Industry

• Insurance Industry

| | • International

• Investments

• Risk Management • Talent Management • Technology/Systems

|

| | | | | | | | | | | | | |  | |

Michael A. Todman Age:5961 Director Since:March 2016 | | Prudential Committees: • Compensation • Finance | | Public Directorships: • Brown-Forman Corporation • Newell Rubbermaid, Inc.Brands | | | | | | | | | | | |

Mr. Todman served as Vice Chairman of the Whirlpool Corporation (Whirlpool), a global manufacturer of home appliances, from November 2014 to December 2015. Mr. Todman previously served as President of Whirlpool International from 2006 to 2007 and 2010 to 2014, as well as President, Whirlpool North America from 2007 to 2010. Mr. Todman held several senior positions including Executive Vice President and President of Whirlpool Europe from 2001 to 2005 and Executive Vice President, Whirlpool North America, in 2001. Prior to joining Whirlpool, Mr. Todman served in a variety of leadership positions at Wang Laboratories Inc. and Price Waterhouse and Co.

| | | | | Mr. Todmanserved as Vice Chairman of the Whirlpool Corporation (Whirlpool), a global manufacturer of home appliances, from November 2014 to December 2015. Mr. Todman previously served as President of Whirlpool International from 2006 to 2007 and 2010 to 2014, as well as President, Whirlpool North America, from 2007 to 2010. Mr. Todman held several senior positions, including Executive Vice President and President of Whirlpool Europe from 2001 to 2005 and Executive Vice President, Whirlpool North America, in 2001. | | Skills & Qualifications | | | • Business Head/Administration • Business Operations • Corporate Governance • Finance/Capital Allocation • Government/Public Policy • International • Marketing/Sales | | • Risk Management • Talent Management | | |

| | | | | | | | 14 16 | | | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement |

| | |

| | Item 1—Election of Directors:Director Nominees | |

| | | | | | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement | | | | 15| | | 17 |

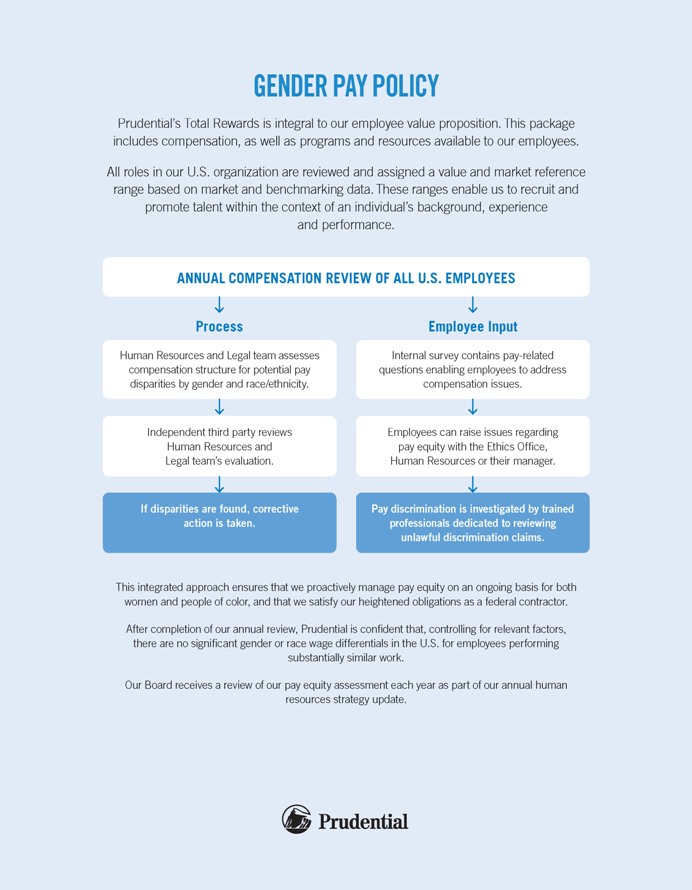

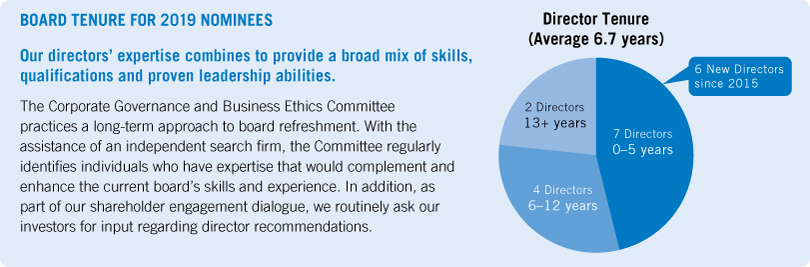

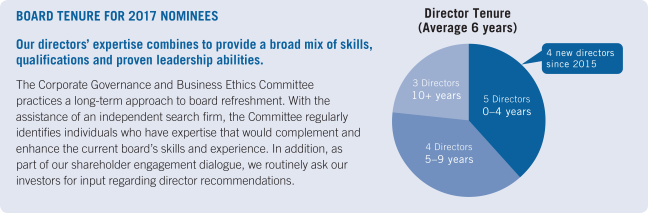

Corporate Governance The Company is committed to good corporate governance, which helps us compete more effectively, sustain our success and build long-term shareholder value. The Company is governed by a Board of Directors and committees of the Board that meet throughout the year. Directors discharge their responsibilities at Board and committee meetings through ongoing communication with each other and also through other communications with management.management throughout the year. The Board has adopted Corporate Governance Principles and Practices to provide a framework for the effective governance of the Company. The Corporate Governance Principles and Practices are reviewed regularly and updated as appropriate. The full text of the Corporate Governance Principles and Practices, which includes the definition of independence adopted by the Board, the charters of the Corporate Governance and Business Ethics, Compensation and Audit Committees, the Lead Independent Director Charter, the Code of Business Conduct and Ethics and the Related Party Transaction Approval Policy can be found at www.prudential.com/governance. Copies of these documents also may be obtained from the Chief Governance Officer and Corporate Secretary. Governance is a continuing focus at the Company, starting with the Board and extending to management and all employees. Therefore, the Board reviews the Company’s policies and business strategies and advises and counsels the CEO and the other executive officers who manage the Company’s businesses, including actively overseeing and reviewing, on at least an annual basis, the Company’s strategic plans. In addition, we solicit feedback from shareholders on corporate governance and executive compensation practices and engage in discussions with various groups and individuals on governance issues and improvements.these matters. Process for Selecting Directors The Corporate Governance and Business Ethics Committee screens and recommends candidates for nomination by the full Board. The Company’sBy-laws provide that the size of the Board may range from 10 to 24 members. The15 members, reflecting the Board’s current view is that theof its optimal size is between 10 and 15 members.size. The Committee is assisted with its recruitment efforts by an independent third partythird-party search firm, which recommends candidates that satisfy the Board’s criteria. The search firm also provides research and pertinent information regarding candidates, as requested.

Source Candidate Pool from Independent Search Firms Shareholders Independent Directors Our Source Candidate Pool from Independent Search Firms Shareholders Independent Directors Our Peoplepeople In-Depth Review by the Committee Consider Skills Matrixskills matrics Screen qualifications Consider diversity Review independence and potential conflicts Meet with directors Recommend Selected Candidate for Appointment to our Board Review by full boardBoard Select Director(s) 4 new5 directors since May 20162015

| | | | | 16 | | | 18 | | | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement |

| | |

| | Corporate Governance | |

Shareholder Nominations and Recommendations of Director Candidates We amended ourOurBy-laws in March 2015 to permit a group of up to 20 shareholders who have owned at least 3% of our outstanding capital stock for at least three years to submit director nominees for up to 20% of theour Board seats for inclusion in our Proxy Statement if the shareholder(s) and the nominee(s) meet the requirements in ourBy-laws.

Shareholders who wish to nominate directors for inclusion in our Proxy Statement or directly at an Annual Meeting in accordance with the procedures in ourBy-laws should follow the instructions under “Submission of Shareholder Proposals and Director Nominations” in this Proxy Statement. Shareholders who wish to recommend candidates for consideration should send their recommendations to the attention of Margaret M. Foran, Chief Governance Officer, Senior Vice President and Corporate Secretary, at 751 Broad Street, Newark, NJ 07102. The Committee will consider director candidates recommended by shareholders in accordance with the criteria for director selection described under “Director Criteria, Qualifications, Experience and Tenure.” Director Attendance During 2016,2018, the Board of Directors held 11eight meetings. Together, the directors attended 99% of the combined total meetings of the full Board and the committees on which they served in 2016, and no director attended less than 83% of the combined total meetings of the full Board and the committees on which he or she served in 2016.2018. Director Independence The current Board consists of 13 directors, twothree of whom are currently employed by the Company (Messrs. Lowrey, Grier and Strangfeld). As announced, Mr. Strangfeld will leave the Board on April 5, 2019 and Grier).will not stand for election at the 2019 Annual Meeting. Mr. Falzon, who will join the Board in August 2019 upon Mr. Grier’s retirement, is Vice Chairman of the Company. The Board conducted an annual review and affirmatively determined that all of thenon-employee directors (Mss.(Mses. Hund-Mejean, Pianalto and Poon, and Messrs. Baltimore, Casellas, Cullen, Krapek, Lighte, Paz, Scovanner and Todman) are “independent” as that term is defined in the listing standards of the NYSE and in Prudential Financial’sPrudential’s Corporate Governance Principles and Practices. In addition, the Board previously determined that Mr. Bethune and Ms. Horner, who did not stand forre-election at our 2016 Annual Meeting, were “independent” directors. Independent Director Meetings The independent directors generally meet in an executive session at both the beginning and the end of each regularly scheduled Board meeting, with the Lead Independent Director serving as Chair.

| | | | | | | Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | | | | 17 | |

| | |  | | Corporate Governance

|

Board Leadership

Currently, our Board leadership structure consists of a Lead Independent Director, a Chairman (who is also our CEO) and strong committee chairs. The Board believes that our structure provides independent Board leadership and engagement while providing the benefit of having our CEO, the individual with primary responsibility for managing the Company’sday-to-day operations, chair regular Board meetings as key business and strategic issues are discussed. At this time, the Board believes that the Company is best served by having the same individual as both Chairman of the Board and CEO, but considers the continued appropriateness of this structure at least annually.

In 2016, independent directors and our Chief Governance Officer engaged with shareholders, who held a majority of our shares, on their thoughts on our Board leadership structure. Our Lead Independent Director also met with certain of our shareholders in 2016. The discussions and feedback from these meetings has been given to the Board and will be considered during the annual review of the appropriateness of the Board leadership structure.

Under our Corporate Governance Principles and Practices, the independent directors annually elect an independent director to serve as Lead Independent Director for a term of at least one year, but for no more than three years. Mr. Krapek has served as our Lead Independent Director since May 2014. A new Lead Independent Director will be elected by the independent directors immediately after the 2017 Annual Meeting. The responsibilities and authority of the Lead Independent Director include:

presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors;

authorization to call meetings of the independent directors;

serving as a liaison between the Chairman and the independent directors;

approving information sent to the Board, including the quality, quantity, appropriateness and timeliness of such information;

approving meeting agendas for the Board;

approving meeting schedules to assure there is sufficient time for discussion of all agenda items;

authorization to retain outside advisors and consultants who report directly to the Board of Directors on board-wide issues; and

ensuring that he/she be available, if requested by shareholders, when appropriate, for consultation and direct communication.

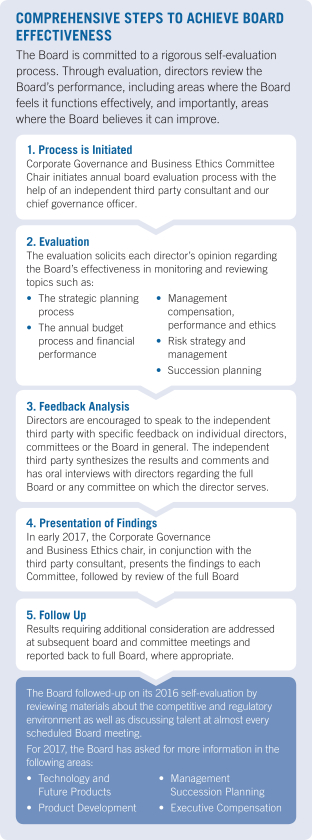

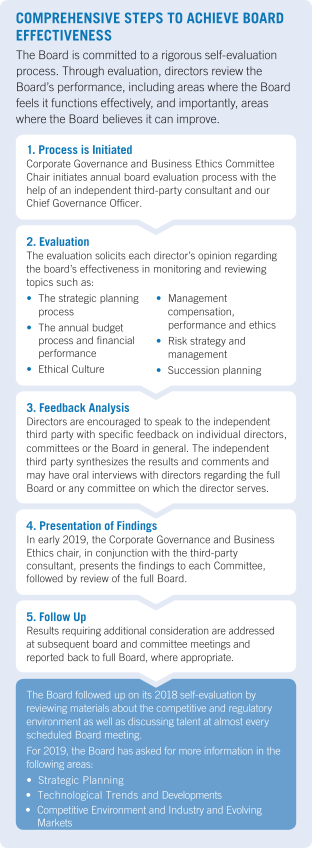

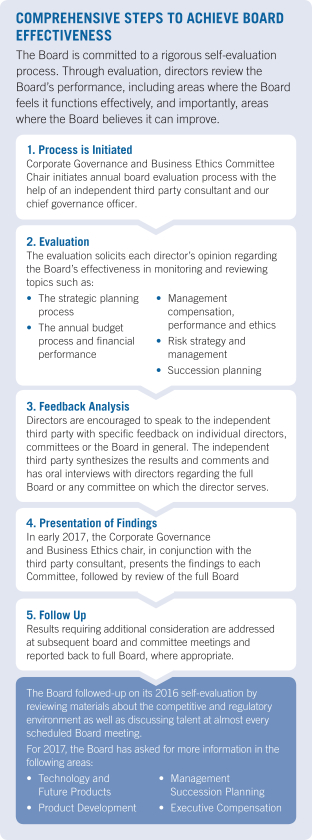

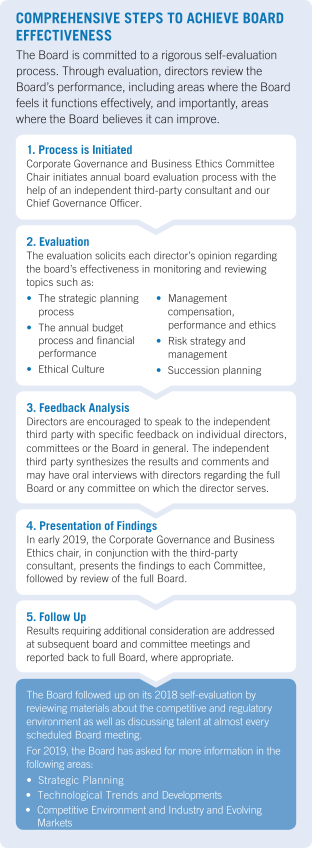

COMPREHENSIVE STEPS TO ACHIEVE BOARD EFFECTIVENESS The Board is committed to a rigorous COMPREHENSIVE STEPS TO ACHIEVE BOARD EFFECTIVENESS The Board is committed to a rigorous self evaluationself-evaluation process. Through evaluation, directors review the Board’sBoard's performance, including areas where the Board feels it functions effectively, and importantly, areas where the Board believes it can improve.1.improve. 1. Process is Initiated Corporate Governance and Business Ethics Committee Chair Initiatesinitiates the annual board evaluation process with the help of an independent third partythird-party consultant and our chief governanceCapitalize Chief Governance officer. 2. Evaluation The evaluation solicits each director’sdirector's opinion regarding the board’sBoard's effectiveness in monitoring and reviewing topics such as:as The strategic planning process The annual budget process and financial performance Management compensation, performance and ethics Risk strategy and management Succession planning 3. Feedback Analysis Directors are encouraged to speak to the independent third party with specific feedback on individual directors, committees or the Board in general. The independent third party synthesizes the results and comments and may have oral interviews with directors regarding the full Board or any committee on which the director serves. 4. Presentation of Findings At the January board meeting,In early 2019, the Corporate Governance and Business Ethics chair,Chair, in conjunction with the independent, third party consultant, presents the findings to each Committee, followed by review of the full BoardBoard. 5. Follow Upup Results requiring additional consideration are addressed at subsequent board and committee meetings and reported back to full Board, where appropriate. The Board followed-up on its most recent2018 self-evaluation by reviewing materials about the competitive and regulatory environment as well as discussing talent at almost every scheduled Board meeting. For 2017,2019, the Board has asked for more information in the following areas: TechnologyStrategic Planning Technological Trends and Future Products Product Development Management Succession Planning Executive CompensationDevelopments Competitive Environment and Industry and Evolving Markets

| | | | | | | | 18 | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement | | | | | 19 |

| | |

| | Corporate Governance | |

Letter from the Lead Independent DirectorBoard Leadership

Under Prudential’s Corporate Governance Principles, the independent directorsCurrently, our Board leadership structure consists of the Board annually elect a Lead Independent Director, and until April 5, 2019, aNon-Executive Chairman (who is our former CEO) as well as strong committee chairs. As previously announced, Mr. Lowrey, our CEO, will become Chairman on April 5, 2019. The Board believes that our structure provides independent Board leadership and engagement while providing the benefit of having our CEO, the individual with primary responsibility for managing the Company’sday-to-day operations, chair regular Board meetings as key business and strategic issues are discussed.

The Board regularly reviews its leadership structure, and the Board thoroughly evaluated whether to continue to combine or to split the chair and CEO roles in the months leading up to the Company’s recent CEO transition. After considering the perspectives of the independent directors, the views of our significant shareholders, voting results of recent independent chair proposals, academic research, practical experience at peer companies, and benchmarking and performance data, the Board determined that having the former CEO becomeNon-Executive Chairman, followed by Mr. Lowey as Chairman and CEO was in the best interests of the Company and its shareholders. The Board will continue to monitor the appropriateness of this structure. In 2018, independent directors and our Chief Governance Officer engaged with shareholders who hold a majority of our shares on their views on our Board leadership structure. Our Lead Independent Director and our chair of the Corporate Governance and Business Ethics Committee, as well as the full Board, also met with certain of our shareholders in 2018. The discussions and feedback from these meetings have been shared with the Board and will be considered during the Board’s annual review of the appropriateness of its leadership structure. Under our Corporate Governance Principles and Practices, the independent directors annually elect a Chairman of the Board and, if the individual elected as Chairman of the Board is the CEO, they also elect an independent director to serve as Lead Independent Director. The Lead Independent Director is generally expected to serve for a term of at least one year, but for no more than three years. I am honored that my fellowMr. Baltimore was elected as Lead Independent Director for his second term in May 2018. The responsibilities and authority of the Lead Independent Director include: presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors elected medirectors; authorization to servecall meetings of the independent directors; serving as a liaison between the Chairman and the independent directors; approving information sent to the Board, including the quality, quantity, appropriateness and timeliness of such information; approving meeting agendas for the last three years. My term endsBoard; approving meeting schedules to assure there is sufficient time for discussion of all agenda items; authorization to retain outside advisors and consultants who report directly to the Board on Board-wide issues; and ensuring that he or she be available, if requested by shareholders, when appropriate, for consultation and direct communication. | | | | | | | | 20 | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement |

| | |

| | Corporate Governance | |

PRUDENTIAL FOLLOWS THE INVESTOR STEWARDSHIP GROUP’S (ISG) CORPORATE GOVERNANCE FRAMEWORK FOR U.S. LISTED COMPANIES | | | | ISG Principle | | Prudential Practice | Principle 1: Boards are accountable to shareholders. | | • All directors stand for election annually • Proxy access with market terms • Board and Lead Independent Director letters and videos provide large and small investors insight into Board strategy and oversight objectives, and corporate governance practices | Principle 2: Shareholders should be entitled to voting rights in proportion to their economic interest. | | • No dual class structure; each shareholder gets one vote per share • Majority voting in uncontested director elections, and directors not receiving majority support must tender their resignation for consideration by the Board | Principle 3: Boards should be responsive to shareholders and be proactive in order to understand their perspectives. | | • Management and Board members met with investors owning a majority of shares outstanding in 2018 • Engagement topics included sustainability and social strategy, Board composition, leadership and refreshment, succession planning, and executive compensation program | Principle 4: Boards should have a strong, independent leadership structure. | | • Strong Lead Independent Director with clearly defined duties that are disclosed to shareholders • Board considers appropriateness of its leadership structure at least annually • Strong Independent Committee Chairs • Proxy discloses why Board believes current leadership structure is appropriate | Principle 5: Boards should adopt structures and practices that enhance their effectiveness. | | • As of April 5, 2019, 83% of Board members are independent • 80% of our independent Board members are diverse • Annual Board evaluation by independent third party; results and next steps summarized in proxy statement • Active Board refreshment plan; five new Board members refreshment in last four years • Directors attended 99% of combined total Board and applicable committee meetings in 2018, and all directors attended the 2018 Annual Meeting | Principle 6: Boards should develop management incentive structures that are aligned with the long-term strategy of the company. | | • Executive Compensation program received approximately 96% shareholder support in 2018 • Compensation Committee annually reviews and approves incentive program design, goals and objectives for alignment with compensation and business strategies • Annual and long-term incentive programs are designed to reward financial and operational performance that furthers short- and long-term strategic objectives | | | |

SHAREHOLDER ENGAGEMENT This year, we continued our practice of engagement, communication, and transparency in May 2017, effective ata variety of ways, including the following: | • | | released two videos featuring Board members, Thomas J. Baltimore, our Lead Independent Director, and Douglas A. Scovanner, Chair of our Audit Committee, sharing their views on Prudential’s Board and corporate governance practices; | |

| • | | promoted greater communication with our institutional shareholders on corporate governance issues by engaging with shareholders who collectively hold a majority of our shares; | |

| • | | advanced open Board communication by facilitating interaction between our directors and shareholders; and | |

| • | | provided multiple avenues for shareholders to communicate with the Company and the Board, and have received and responded to shareholder comments. Shareholders also continued to use the mechanisms available through www.prudential.com/governance to provide input. | |

| | | | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement | | | | | 21 |

| | |

| | A Message to our Shareholders from Prudential’sLead Independent Director | |

Letter from the Lead Independent Director As Prudential’s lead independent director, it is a privilege to share with you the Board’s view on the Company’s governance practices that we believe reflect our Annual Meeting. Our directors share myongoing commitment to strong, independent leadership,building long-term shareholder value. Succession Planning Succession planning is paramount to the Board’s oversight and is a point of discussion and deliberation at every Board effectivenessmeeting. In September 2018, John Strangfeld announced his retirement ending his11-year tenure as Prudential’s CEO and oversight. In this context, I would likeChairman. The Board was honored to share insights into our philosophyannounce the appointments of Charles Lowrey, former Executive Vice President and practices on several important issues.Chief Operating Officer, International Businesses, to the role of Chief Executive Officer, and Robert Falzon, former Executive Vice President and Chief Financial Officer, to the role of Vice Chairman, succeeding Mark Grier. Strategic Oversight

As partThese transitions are indicative of the annualdepth and breadth of the firm’s talent pool. Charlie and Rob are accomplished business leaders with significant related experience that will shape Prudential’s strategic planning process,vision and long-term strategy.

Board Effectiveness It is our goal to operate our Board reviewsin the Company’s strategy, opportunities, challenges, capabilitiesmost effective manner possible, and leadership to ensure the Company is well-positioned to continue creating value for shareholders. My fellow independent directors and I are committed to, and value, our dialogue with management regarding the Company’s disciplined risk assessment, capital allocation strategy and long-term plans for growth. Board Governance

Effective governance means ongoing and thoughtfulwe believe a rigorous annual evaluation of our governance structure, and constructive shareholder engagement on emerging governance issues. In 2016, our engagement efforts, which included my personal involvement and that of other directors, reached investors holding the majority of our outstanding shares.

Our recent shareholder engagement dialogue about governance has focused on, among other things, Board composition, refreshment and our Board’s leadership structure. Understanding the importance of the Board’s responsibility to provide effective oversight, we strive to maintain an appropriate balance of tenure, diversity, skills, and experience on the Board. Since 2015, four new independent directors have joined our Board to replace long-tenured directors. In addition, directors from diverse backgrounds comprisetwo-thirds of our Board.

Board Evaluation

We are committed to provide transparency to our robust Board and committee evaluation process, which is led by an independent third party is an essential component of good governance practices. Every year, the Corporate Governance and Business Ethics Committee works with an experienced, third-party consultant. Our proxy statement not only describes each stepconsultant to complement our internal evaluation efforts by introducing an objective perspective and knowledge of best practices. We believe this approach adds rigor to the evaluation process, but also provides specificprocess.

Board Composition and Refreshment We believe strong governance begins with an independent, engaged and diverse board – 80% of our independent board members are diverse. With these guiding principles, the Corporate Governance and Business Ethics Committee screens and recommends Board candidates for nomination with the goal of evolving the composition of our Board in line with the strategic needs of our global customers. Using our skills matrix as a guide, individual conversations with directors, and the assistance of an independent search firm, the Committee identifies areas where our directors seek improvement.of expertise that would complement and enhance the current Board’s skills and experience. Over the past several years, we have added five new Board members. Governance Policies and Practices We continue to maintain our focus on strong governance practices thatwhich we believe are important to our shareholders and protect the long-term vitality of the Company. Our accountability to you is indicativeillustrated in our policies such as: proxy access, a strong Lead Independent Director role, the right of shareholders to call a special meeting, the annual director elections by majority vote, annual election of directors, and a robust clawback policy. My board colleague, Gilbert Casellas, chairmanDouglas Scovanner, chair of our Corporate Governance and Business Ethicsthe Audit Committee, and I address these topics in two short videos. You can access the videos from the Corporate Governance section of our website at www.prudential.com/directorvideos. We see these videos as an important component of our ongoing efforts to share information with shareholders. Prudential’s founder, John Dryden, stated thatOn behalf of our shareholders, your Board is committed to maintaining our diligence in overseeing the “justification of the company’s existence is its advancement of the efforts of its policy holdersfirm’s performance, risk management, and their families for better economicinvestment in our people and social condition.” More than 140 years after Mr. Dryden’s proclamation, my fellow directors and I are proud to carry on this purpose on your behalf.communities.

Sincerely,

Thomas J. Baltimore Lead Independent Director | | | | | |  |

| |

KarlThomas J. KrapekBaltimore

Mr. Baltimore was elected by Prudential’s independent directors to serve as Lead Independent Director effective May 9, 2017. Mr. Baltimore brings significant experience and knowledge to the Lead Independent Director role. He has served as a Prudential director since 2008. During his tenure, he has chaired the Investment, Executive and Risk Committees, and served on the Compensation and Finance Committees. Due to his Board experience and leadership, Mr. Baltimore understands the Company’s long-term strategic priorities. In addition, he possesses a deep understanding of Prudential and its industry’s legal, regulatory, and competitive frameworks. | | |

| | | | | | | | 22 | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement |

| | |

| | Corporate Governance | |

Why our Board Structure Is Right for Prudential and its Shareholders Prudential’s Board leadership structure is reviewed by our Corporate Governance and Business Ethics Committee regularly. Upon John Strangfeld’s retirement, the Board again gave careful deliberation to its structure and determined that a combined Chairman-CEO role continues to be in the best interest of our firm and shareholders. As independent directors, we believe the current structure promotes an effective Board that enables us to provide strategic guidance, challenge management’s perspectives, and meet with relevant internal and external constituents important to the Company’s operational and regulatory initiatives. The independent directors annually select an independent member to serve as the Lead Independent Director. As required by the Lead Independent Director Charter, the Lead Independent Director is precluded from serving longer than three consecutive years. Charles Lowrey, former executive vice president and chief operating officer of Prudential’s International Businesses, was appointed CEO on December 1, 2018. He will be appointed Chairman on April 5, 2019. Charlie’s successful leadership of the Company’s asset management, U.S. and international businesses enables him to bring a broad perspective of Prudential’s operations, a deep understanding of our people, and leadership skills that will serve the Company well as it continues to grow. The Board believes a Chairman-CEO structure provides Prudential with a clear and effective leadership role to communicate the Company’s business and long-term strategy to its clients, shareholders and the public. The combination also provides for robust and frequent communication between the Board’s independent directors and Company management. On behalf of our shareholders, the Board is committed to advancing our momentum in the market. This transition is the result of a thoughtful, phased and long-term approach to succession planning. Lead Independent Director:Key Responsibilities Calls meetings of the independent directors Facilitates communication between the independent directors and our Chairman Provides independent Board leadership Elected annually to serve no more than three years Sets agenda for all Board meetings and approves all Board material Communicates with shareholders and other key constituents, as appropriate Meets directly with the management andnon-management employees of our firm Engages with our other independent directors to identify matters for discussion at executive sessions of independent directors and advises our Chairman of any decisions reached, and suggestions made at the executive sessions In collaboration with the Corporate Governance and Business Ethics Committee, addresses Board effectiveness, performance and composition Authorized to retain outside advisors and consultants who report directly to the Board on Board-wide issues | Culture at Prudential At Prudential, nearly 50,000 employees from around the globe bring their diverse backgrounds and perspectives to work every day in

pursuit of the company’s shared purpose: making lives better by solving the financial challenges of a changing world. Drawing on a wide range of expertise and experience across a multitude of disciplines, we are bound by our commitment to what we do

and how we work together. This means that culture is a unique differentiator and a long-term competitive advantage for Prudential. It fuels our ability to execute in differentiated ways and is a critical underpinning of our talent strategy. Therefore, we invest in understanding and developing our culture. We want to ensure that it is as inclusive and collaborative as it can be, and that it supports how we compete in an evolving marketplace. In July 2018, Prudential asked thousands of employees across the United States to share their vision for our culture and for Prudential. Solicited in a spirit of candor and continual improvement, the results provided valuable guidance for our approach to business challenges and talent opportunities. These results were shared with the Board of Directors and senior leadership, and the feedback will help the company support a fully inclusive culture that unlocks the best-in-class execution, collaboration, and performance of our talent. |

| | | | | | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement | | | | 19| | | 23 |

| | |

| | Corporate Governance | |

Board Risk Oversight The Board oversees the Company’s risk profile and management’s processes for assessing and managing risk, through both as athe whole Board and through its committees. At least annually, the Board reviews strategic risks and opportunities facing the Company and certain of its businesses. Other important categories of risk are assigned to designated Board committees (which are comprised solely of independent directors) that report back to the full Board. In general, the committees oversee the following risks: Audit Committee:insurance risk and operational risks, including model risk, as well as risks related to financial controls, legal, regulatory and compliance issues,risks, and the overall risk management governance structure and risk management function; Compensation Committee:the design and operation of the Company’s compensation programs so that they do not encourage unnecessary or excessive risk-taking; Corporate Governance and Business Ethics Committee:the Company’s overall ethical culture, political contributions, lobbying expenses and overall political strategy, as well as the Company’s environmental risk (which includes climate risk), sustainability and corporate social responsibility to minimize reputational risk and focus on future sustainability; Finance Committee:liquidity risk, risks related toinvolving our capital and liquidity management, the incurrence and repayment of borrowings, the capital structure of the enterprise, funding of benefit plans and the levels ofstatutory insurance reserves and policyholder dividends;reserves; Investment Committee:investment risk, market risk and the strength of the investment function; and Risk Committee:the governance of significant risks throughout the Company, the Company’s overallestablishment and ongoing monitoring of our risk profile, risk capacity and risk appetite, and coordination of the risk oversight functions of the other Board committees. In performing its oversight responsibilities, the Board and its committees review policies and guidelines that senior management uses to manage the Company’s exposure to material categories of risk. As these issues sometimes overlap, Board committees hold joint meetings when appropriate and address certain issues at the full Board level. During 2016,2018, the full BoardRisk Committee received a reportan update from the Chief Risk Officer on the important strategic issues and risks facing the Company. In addition, the Board and committees review the performance and functioning of the Company’s overall risk management function. The Risk Committee is comprised of the chairs of each of the other Board committees.committees and Mark Grier, our Vice Chairman, who supervises the Chief Risk Officer of the Company. The principal activities of the Risk Committee are to: oversee the Company’s assessment and reporting of material risks by reviewing the metrics used by management to quantify risk, applicable risk limit structures and risk mitigation strategies; review the Company’s processes and procedures for risk assessment and risk management, including the related assumptions used across the Company’s businesses and material risk types; and receive reports from management on material and emerging risk topics that are reviewed by the Company’s internal management committees. The Company, under the Board’s oversight, is organized to promote a strong risk awareness and management culture. The Chief Risk Officer sits on many management committees and heads an independent enterprise risk management department; the General Counsel and Chief Compliance Officer also sit on key management committees and the functions they oversee operate independently of the businesses to separate management and oversight. Employee appraisals evaluate employees with respect to risk and ethics. Cybersecurity Risk Oversight In addition, the Board oversees the Company’s cyber risk management program. In order to respond to the threat of security breaches and cyberattacks, we have developed a program, overseen by the Company’s Chief Information Security Officer and our Information Security Office, that is designed to protect and preserve the confidentiality, integrity and continued availability of all information owned by, or in the care of, the Company. This program also includes a cyber incident response plan that provides controls and procedures for timely and accurate reporting of any material cybersecurity incident. The Audit Committee, which is tasked with oversight of certain risk issues, including cybersecurity, receives periodic reports from the Chief Information Security Officer, the Chief Information Officer and the Head of Operational Risk. The Board and the Audit Committee also periodically receive updates about the results of exercises and response readiness assessments led by outside advisors who provide a third-party independent assessment of our technical program and our internal response preparedness. The Audit Committee regularly briefs the full Board on these matters, and the full Board also receives periodic briefings on cyber threats in order to enhance our directors’ literacy on cyber issues. | | | | | | | | 24 | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement |

| | |

| | Corporate Governance | |

Executive Compensation Risk Oversight We monitor the risks associated with our executive compensation programprograms and individual executive compensation decisions on an ongoing basis. Each year, management undertakes a review of the Company’s various compensation programs to assess the risks arising from our compensation policies and practices. Management presents these risk assessments to the Compensation Committee. The risk assessments have included a review of the primary design features of the Company’s compensation plans, the process to determine compensation pools and awards for employees and an analysis of how those features could directly or indirectly encourage or mitigate risk-taking. As part of the risk assessments, it has been noted that the Company’s compensation plans allow for discretionary negative adjustments to the ultimate outcomes, which serves to mitigate risk-taking. Moreover, senior management is subject to a share ownership and retention policy,policies, and historically a large percentage of senior management compensation has been paid in the form of long-term equity awards. In addition, senior management compensation is paid over a multiple-year cycle, a compensation structure that is intended to align incentives with appropriate risk-taking. The Company’s general risk management controls also serve to preclude decision-makers from taking excessive risk to earn the incentives provided under our compensation plans. The Compensation Committee agreed with the conclusion that the identified risks were within our ability to effectively monitor and manage, and that our compensation programs do not encourage unnecessary or excessive risk-taking and do not create risks that are reasonably likely to have a material adverse effect on the Company. | | | | | 20 | | | Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

| | |  | | Corporate Governance

|

Succession Planning The Board is actively engaged and involved in talent management. The Board reviews the Company’s “people strategy” in support of its business strategy at least annually and frequently discusses talent issues at its meetings. This includes a detailed discussion of the Company���sCompany’s global leadership bench and succession plans with a focus on key positions at the senior officer level. As a result of this approach, the Board was well positioned to execute on its succession plan in 2018, including the appointment of Mr. Lowrey to succeed Mr. Strangfeld as CEO and Chairman and Mr. Falzon to succeed Mr. Grier as Vice Chairman. In addition, the committees of the Board regularly discuss the talent pipeline for specific critical roles. High potentialHigh-potential leaders are given exposure and visibility to Board members through formal presentations and informal events. More broadly, the Board is regularly updated on key talent indicators for the overall workforce, including diversity, recruiting and development programs. Communication with Directors Shareholders and other interested parties may communicate with any of the independent directors, including Committee Chairs and the Lead Independent Director, by using the following address: Prudential Financial, Inc. Board of Directors c/o Margaret M. Foran, Chief Governance Officer, Senior Vice President and Corporate Secretary 751 Broad Street Newark, NJ 07102 Email: independentdirectors@ prudential.com Feedback on Executive Compensation: You can also provide feedback on executive compensation at the following website: www.prudential.com/ executivecomp. The Chief Governance Officer and Corporate Secretary of the Company reviews communications to the independent directors and forwards those communications to the independent directors as discussed below. Communications involving substantive accounting or auditing matters will be immediately forwarded to the Chair of the Audit Committee and the Company’s Corporate Chief Ethics Officer consistent with time frames established by the Audit Committee for the receipt of communications dealing with these matters. Communications that pertain tonon-financial matters will be forwarded promptly. Items that are unrelated to the duties and responsibilities of the Board will not be forwarded, such as: business solicitation or advertisements; product-related inquiries; junk mail or mass mailings; resumes or otherjob-related inquiries; spam and overly hostile, threatening, potentially illegal or similarly unsuitable communications. SHAREHOLDER ENGAGEMENT

This year, we continued our practice of engagement, communication, and transparency in a variety of ways, including the following:

| • | | released two videos featuring Board members, Karl J. Krapek, our Lead Independent Director, and Gilbert Casellas, Chair of our Corporate Governance and Business Ethics Committee, sharing their views on Prudential’s Board and governance practices; | |

| • | | provided multiple avenues for shareholders to communicate with the Company and the Board. We have received almost 15,000 shareholder comments in the last six years. Shareholders also continued to use the mechanisms available through www.prudential.com/governance to provide input; | |

| • | | promoted greater communication with our institutional shareholders on corporate governance issues by engaging with shareholders who collectively held a majority of our shares; | |

| • | | advanced open Board communication by facilitating interaction between our directors and shareholders; and | |

| • | | received nomination from Corporate Secretary Magazine for Best Proxy Statement for a Large Cap Company. | |

| | | | | | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement | | | | 21| | | 25 |

| | |

| | Corporate Governance | |

Committees of the Board of Directors The Board has established various committees to assist in discharging its duties, including: Audit, Compensation, Corporate Governance and Business Ethics, Executive, Finance, Investment and Risk. The primary responsibilities of each of the committees are set forth below, together with their current membership and the number of meetings held in 2016.2018. Committee charters can be found on our website at www.prudential.com/governance. Each member of the Audit, Compensation, and Corporate Governance and Business Ethics Committees has been determined by the Board to be independent for purposes of the NYSE Corporate Governance listing standards. In addition, directors who serve on the Audit Committee and the Compensation Committee meet additional, heightened independence and qualification criteria applicable to directors serving on these committees under the NYSE listing standards. | | | | | Committees | | Members & Meetings in 20162018 | | Description | Audit Committee Meetings in 2016:2018: 10 | | Douglas A. Scovanner (Chair) Martina-Hund Mejean George Paz | | The Audit Committee provides oversight of the Company’s accounting and financial reporting and disclosure processes, the adequacy of the systems of disclosure and internal control established by management, and the audit of the Company’s financial statements. The Audit Committee oversees insurance risk and operational risks, risks related to financial controls, and legal, regulatory and compliance matters, and oversees the overall risk management governance structure and risk management function. Among other things, the Audit Committee: (1) appoints the independent auditor and evaluates its qualifications, independence and performance; (2) reviews the audit plans for and results of the independent audit and internal audits; and (3) reviews reports related to processes established by management to provide compliance with legal and regulatory requirements. The Board of Directors has determined that all of our Audit Committee members are financially literate and are audit committee financial experts as defined by the SEC. | Compensation Committee Meetings in 2016:2018: 7 | | Karl J. Krapek (Chair) Thomas J. Baltimore Michael A. Todman | | The Compensation Committee oversees the Company’s compensation and benefits policies and programs. For more information on the responsibilities and activities of the Compensation Committee, including the Committee’s processes for determining executive compensation, see the CD&A. | Corporate Governance & Business Ethics Committee Meetings in 2016: 62018: 7 | | Gilbert F. Casellas (Chair) Peter R. Lighte Sandra Pianalto | | The Corporate Governance and Business Ethics Committee oversees the Board’s corporate governance procedures and practices, including the recommendations of individuals for the Board, making recommendations to the Board regarding director compensation and overseeing the Company’s ethics and conflict of interest policies, its political contributions and lobbying expenses policy, and its strategy and reputation regarding environmental stewardship, sustainability, and sustainabilitycorporate social responsibility throughout the Company’s global businesses. | Executive Committee(1) Meetings in 2016:2018: 0 | | Karl J. Krapek (Chair)

Thomas J. Baltimore (Chair) Gilbert F. Casellas Karl J. Krapek Charles F. Lowrey Christine A. Poon Douglas A. Scovanner John R. Strangfeld | | The Executive Committee is authorized to exercise the corporate powers of the Company between meetings of the Board, except for those powers reserved to the Board by ourBy-laws or otherwise. | Finance Committee Meetings in 2016: 72018: 5 | | Christine A. Poon (Chair) James G. Cullen

Sandra Pianalto Michael A. Todman | | The Finance Committee oversees, takes actions, and approves policies with respect to capital, liquidity, borrowing levels, reserves, subsidiary structurebenefit plan funding and major capital expenditures. | Investment Committee Meetings in 2016:2018: 4 | | Thomas J. Baltimore (Chair) James G. Cullen

Peter R. Lighte Christine A. Poon | | The Investment Committee oversees and takes actions with respect to the acquisition, management and disposition of invested assets; reviews the investment performance of the pension plan and funded employee benefit plans; and reviews investment risks and exposures, as well as the investment performance of products and accounts managed on behalf of third parties. | Risk Committee Meetings in 2016: 72018: 5 | | Karl J. Krapek (Chair)

Thomas J. Baltimore (Chair) Gilbert F. Casellas Mark B. Grier Karl J. Krapek Christine A. Poon Douglas A. Scovanner | | The Risk Committee oversees the governance of significant risks throughout the enterprise including by coordinating the risk oversight functions of each Board committee and seeing that matters are appropriately elevated to the Board. |

| (1) | Charles Lowrey was elected to the Executive Committee on January 25, 2019 |

In addition to the above Committee meetings, the Board held 11eight meetings in 2016.2018. | | | | | 22 | | | 26 | | | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement |

| | |

| | Corporate Governance | |

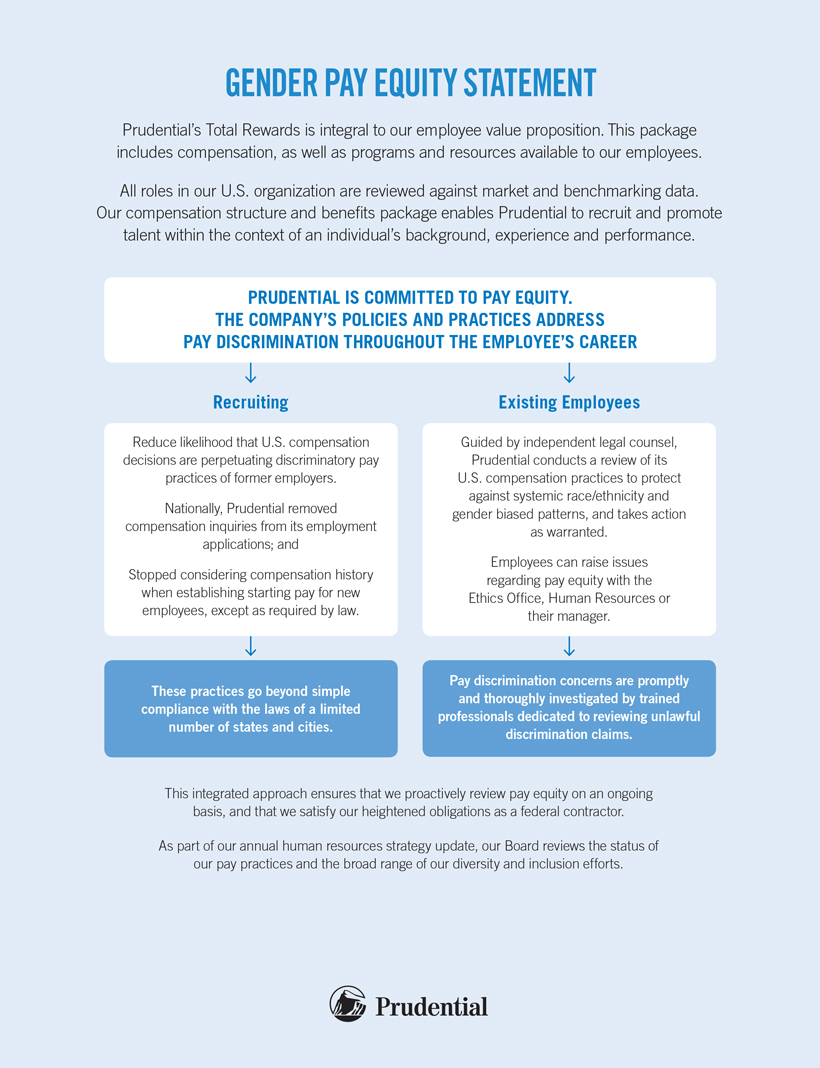

Certain Relationships and Related Party Transactions The Company has adopted a written Related Party Transaction Approval Policy that applies: to any transaction or series of transactions in which the Company or a subsidiary is a participant; when the amount involved exceeds $120,000; and when a related party (a director or executive officer of the Company, any nominee for director, any shareholder owning an excess of 5% of the total equity of the Company and any immediate family member of any such person) has a direct or indirect material interest (other than solely as a result of being a director or trustee or in any similar position or a less than 10 percent10% beneficial owner of another entity). The policy is administered by the Corporate Governance and Business Ethics Committee. The Committee will consider relevant facts and circumstances in determining whether or not to approve or ratify such a transaction, and will approve or ratify only those transactions that are, in the Committee’s judgment, appropriate or desirable under the circumstances. In the ordinary course of business, we may from time to time engage in transactions with other corporations or financial institutions whose officers or directors are also directors of Prudential Financial. In all cases, these transactions are conducted on anarm’s-length basis. In addition, from time to time executive officers and directors of Prudential Financial may engage in transactions in the ordinary course of business involving services we offer, such as insurance and investment services, on terms similar to those extended to employees of Prudential Financial and its subsidiaries and affiliates generally. The Corporate Governance and Business Ethics Committee has determined that certain types of transactions do not create or involve a direct or indirect material interest, including (i) any sales of financial services or products to a related party in the ordinary course of business on terms and conditions generally available in the market placemarketplace (or at ordinary employee discounts, if applicable) and in accordance with applicable law and (ii) all business relationships between the Company and a 5% shareholder or a business affiliated with a director, director nominee or immediate family member of a director or director nominee made in the ordinary course of business on terms and conditions generally available in the market placemarketplace and in accordance with applicable law. Pursuant to our policy, the Corporate Governance and Business Ethics Committee determined that there were twothree transactions that qualified as related party transactions since the beginning of 2016.2018. The brother of Robert M. Falzon, our ExecutiveVice Chairman, Michael F. Falzon, is our Vice President, and Chief Financial Officer, Michael Falzon, is a Vice President for Infrastructure Systems Development. In 2016,2018, the total compensation paid to Michael Falzon, including salary, bonus and the grant date value of long-term incentive awards, was approximately $480,300.$600,000. Theson-in-law of Barbara Koster, our Senior Vice President and Chief Information Officer, Joshua D. Howard, is an associate in Quantitative Management Associates, a subsidiary of the Company. In 2016,2018, the total compensation paid to Mr. Howard, including salary and bonus, was approximately $141,500.$165,000. The daughter of Timothy L. Schmidt, our Senior Vice President and Chief Investment Officer, Carley J. Berger, is an associate in the actuarial department. In both2018, the total compensation paid to Ms. Berger, including salary and bonus, was approximately $130,000. In all three cases, the individuals’ compensation iswas similar to the compensation of other employees holding equivalent positions. Neither individual is in the reporting chain of the executive officer. SUSTAINABILITY AND ENVIRONMENT

At Prudential, sustainability represents how the Company anticipates and manages future risks and opportunities to meet its long-term promises. Sustainability advocates have noted Prudential’s work in the field, especially the active involvement of the Board and senior leadership. Sustainability highlights in 2016 include:

Providing the Board’s Corporate Governance and Business Ethics Committee with a formal report on the Company’s strategy and developments.

Engaging with industry groups, advocates and shareholders on our efforts. A team of Prudential senior leaders participated in a dialogue with the leader of the Geneva Association’s Extreme Events and Climate Risk Working Group.

Facilitating a dialogue between Ceres, a non-profit advocating sustainability leadership, and selected Company executives on Prudential’s sustainability progress. Prudential receives feedback on its sustainability efforts from Ceres and as part of ongoing stakeholder engagement.

| • | | Receiving LEED Gold Certification from the U.S. Green Building Council for the new Prudential tower in Newark, NJ. | |

| • | | Inviting registered shareholders to steward natural resource conservation by accessing shareholder materials online, voting online and registering for direct deposit of dividends. | |

| • | | Releasing our annual sustainability report — Build, Preserve. Repeat. — with stakeholder input shaping the content. To review the report visitwww.prudential.com/sustainability. | |

| • | | Adhering to the criteria for inclusion in the FTSE4Good Index Series since 2011, which measures the performance of companies’ environmental, social and governance (ESG) practices. | |

| | | | | | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement | | | | 23| | | 27 |

| | |

| | Corporate Governance | |

Policy on Shareholder Rights Plan We do not have a shareholder rights plan. The Board will obtain shareholder approval prior to adopting a future shareholder rights plan unless the Board, in the exercise of its fiduciary duties, determines that under the circumstances then existing, it would be in the best interests of the Company and our shareholders to adopt a rights plan without prior shareholder approval. If a rights plan is adopted by the Board without prior shareholder approval, the plan must provide that it will expire within one year of adoption unless ratified by shareholders. Political Contributions and Lobbying Expenditure Oversight and Disclosure The Corporate Governance and Business Ethics Committee reviews and approves an annual report on political activities, contributions and lobbying expenses. It monitors and evaluates the Company’s ongoing political strategy as it relates to overall public policy objectives for the next year and provides guidance to the Board. We provide on our website a description of our oversight process for political contributions and a summary of PAC contributions. We also includedisclose semiannual information on annual dues, assessments and contributions of $25,000$10,000 or more to trade associations andtax-exempt advocacy groups and a summary of Company policies and procedures for political activity. This disclosure is available at www.prudential.com/governance under the heading “Political Activity & Contributions.” In 2016, Prudential received a

The 2018CPA-Zicklin designation as Trendsetter. This honor represents atop-five ranking for political disclosure and accountability in the 2016CPA-Zicklin Trendsetters Designation Index of Corporate Political Disclosure and Accountability.Accountability ranked Prudential as a Trendsetter company, the highest distinction. This is the fourth consecutive year that Prudential has been recognized for its disclosure, accountability, and political spending oversight. Environmental, Sustainability and Corporate Social Responsibility The Corporate Governance and Business Ethics Committee has oversight of environmental issues and policies. In addition, three of our Board members sit on the Board’s Corporate Social Responsibility Oversight Committee. These directors inform the Company’s social responsibility efforts in investing for financial and social returns, strategic philanthropy, employee engagement and corporate community involvement. 2018 investments include: CORPORATE RESPONSIBILITY

The Office of Corporate Social Responsibility extends the reach of Prudential’s business model to create pathways for all individuals and families to achieve financial and social mobility.

In 2016, Prudential invested:

$41 million in grants to non-profit organizations through The Prudential Foundation; $237273 million in impact investments tonon-profits and businesses that seek to create both a financial and social return. In 2016, the company reached the halfway mark$52.5 million in grants to achieving its goal of having a $1 billion impact investment portfolio by 2020; and

$15nonprofit organizations through The Prudential Foundation. $24.4 million in corporate contributions tonon-profit organizations, including more than $5 million in projects serving U.S. veterans.

More than 92,000 volunteer hours by U.S. Prudential employees continuedimpacting local communities across the Company’s long tradition of corporate community involvement. For these efforts, Prudential has once again been named to the Civic 50 list celebrating America’s most community-minded companies, an honor awarded by thenon-profit organization Points of Light. | | | | | 24 | | | Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

| | |  | | Corporate Governance: Good Governance Practices

|

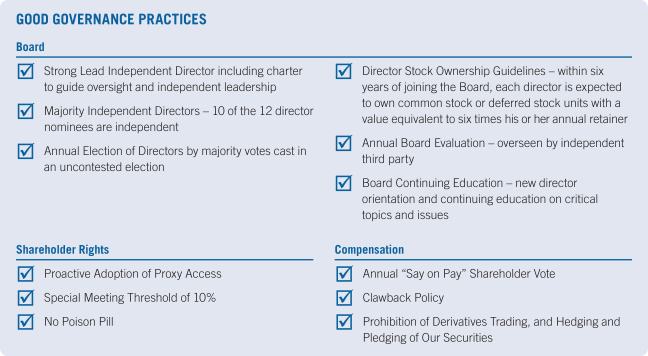

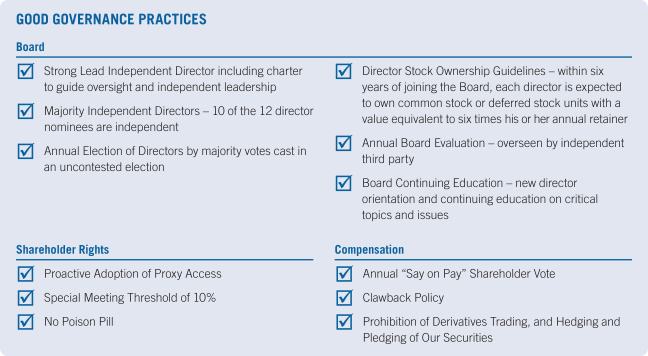

GOOD GOVERNANCE PRACTICES Board Strong Lead Independent Director including charter to guide oversight and independent leadership Majority Independent Directors – 10 of the 12 director nominees are independent Annual Election of Directors by majority votes cast in an uncontested election Shareholder Rights Proactive Adoption of Proxy Access Special Meeting Threshold of 10% No Poison Pill Director Stock Ownership Guidelines – within six years of joining the Board, each director is expected to own common stock or deferred stock units with a value equivalent to six times their annual retainer Annual Board Evaluation – overseen by independent third party every year Board Continuing Education – new director orientation and continuing education on critical topics and issues Compensation Annual Say on Pay Shareholder Vote Clawback Policy Prohibition of Derivatives Trading, and Hedging and Pledging of Our Securitiescountry.

| | | | | | | | 28 | | | | | Notice of Annual Meeting of Shareholders and 20172019 Proxy Statement | | | | 25 | |